* This article was originally published here

Make Money Fast Blog uncovers quick and legit ways to earn money online from anywhere. Perfect for beginners, hustlers, and side-gig seekers, this blog offers daily tips, fast-cash strategies, and real work-from-home methods that require little to no experience. Whether you want to make money today or build a reliable income stream over time, we feature trending tools, offers, and ideas to help you start fast and grow smart.

Wednesday, December 31, 2025

How much will Elon Musk's broadband cost for residential setup? Check internet speed

* This article was originally published here

Tuesday, December 30, 2025

How to Magnetize High Ticket Sales to You

In this video, we’re diving deep into the realm of high ticket sales and how you can effortlessly draw them towards you, eliminating the need for relentless hustle. Hi, I’m Amanda Abella, and welcome to Make Money in Your Honey. On this website, we delve into marketing, sales, systems, and mindset to simplify your business and amplify your life.

Helpful Resources Mentioned In This Video:

- Download our free high ticket sales script here.

- Get all of our mindset, sales and marketing classes by joining our Effortless Revenue Mastermind here.

Why Magnetizing High Ticket Sales Matters

Before we delve into the ‘how,’ let’s discuss why magnetizing high ticket sales is paramount. Many entrepreneurs find themselves caught in the trap of constant hustle, believing that hard work equates to success. However, this narrative often leads to burnout and dissatisfaction. It’s essential to shift our mindset to understand that making money doesn’t have to be arduous.

Internal Work: Cultivating a Money Magnet Mindset

To attract high ticket sales effortlessly, we must first believe that we deserve it. Despite societal conditioning, it’s crucial to rewire our brains to accept that wealth and abundance can flow to us effortlessly. By scripting our goals and affirming our prosperity daily, we reinforce this belief, aligning ourselves with the abundance of the universe.

Becoming a Magnet: Adopting High Ticket Client Characteristics

To draw high ticket sales to you, it’s vital to embody the qualities of high ticket clients. Consider what attributes these clients value and align yourself with them. Just as in relationships, attracting what you desire requires becoming the kind of person that person seeks.

Tactical Strategies: Drawing High Ticket Sales with Precision

Now, let’s explore actionable strategies to magnetize high ticket sales to your business:

1. Search Engine Optimization (SEO)

Utilize SEO to its fullest potential by creating content that addresses the needs of high ticket clients. By providing solutions to their problems, you position yourself as an authority in your niche, attracting qualified leads effortlessly over time.

2. Referrals: Leveraging Connections

Forge strategic connections with individuals who can connect you with high ticket clients. Direct referrals often lead to high conversion rates, as there’s an established trust between parties.

3. Sophisticated Messaging: Targeting High Ticket Clients

Avoid the temptation to oversimplify your marketing message to appeal to the masses. High ticket clients seek sophisticated solutions to their complex problems. Craft your messaging to resonate with their needs, positioning yourself as the ideal solution provider.

Conclusion: Embracing Effortless Success

By implementing these strategies, you can magnetize high ticket sales to your business, alleviating the need for constant hustle. Remember, success doesn’t have to be synonymous with struggle. Embrace a mindset of abundance, embody the characteristics of your ideal clients, and leverage tactical strategies to attract high ticket sales effortlessly.

The post How to Magnetize High Ticket Sales to You first appeared on Make Money Your Honey | scale your business with marketing & sales systems.

* This article was originally published here

Monday, December 29, 2025

Top Organic Lead Generation Strategies for 2024: Social Media Edition

In today’s video, we’re going to be talking about the top organic lead generation strategies for 2024 based on data that I’ve been collecting since the beginning of the year. And guess what? This version of the video is going to be the social media edition, focusing on the social networks that have driven the most traffic, leads, and sales in 2024.

Resources Mentioned In This Video:

- Matomo for tracking analytics

- Our free Notion template for helping you organize your content. You can grab it here.

- Our Effortless Revenue Mastermind where we do a deep dive on social media strategies including those mentioned in the video. Learn more and apply here.

Introduction

I don’t normally do introductions like this on blog posts, but this one merits some context. Over the last couple of years, I’ve become obsessed with tracking data in my business. To be honest, it’s not my natural strong suit as I tend to be more intuitive and creative, but I knew that without learning how to read and analyze analytics that I would be forever stuck on a hamster wheel instead of building a sustainable business that can run 24/7 with or without me. As my life has significantly changed – getting engaged, moving to Mexico, among other things – it’s become important to me that my business doesn’t take up all of my time and that it’s able to run no matter what.

Enter a cool tool called Matomo which Justin got us set up with a few months ago to track everything going on on this website. All I need to do is log into the dashboard and I know exactly what is going on. In this case, I pulled up a pie chart of the social media sources driving the most traffic and leads which you can find below:

I’m going to reference this pie chart throughout the blog post and video. Now let’s get into it…

Why Social Media Matters

To effectively leverage organic lead generation strategies in 2024, social media presence is crucial. Whether it’s YouTube, Facebook, LinkedIn, or surprising contenders like Pinterest and Twitter, these platforms play a pivotal role in driving traffic and generating leads.

Leveraging YouTube for Organic Traffic

YouTube emerges as a powerhouse in our strategy, driving nearly half of all our website traffic. The longevity and compounding effect of video content make it a cornerstone for sustainable lead generation efforts.

Automated Lead Generation Strategies for Facebook and LinkedIn

Despite minimal hands-on management, automated content strategies on Facebook and LinkedIn continue to yield significant leads and traffic. This highlights the efficiency of repurposing YouTube content across multiple platforms.

Unexpected Results from Pinterest and Twitter

Although not actively maintained, Pinterest and Twitter still contribute to our lead generation efforts. Their ability to sustain traffic over time underscores their value as organic traffic sources, especially in niche markets.

The Power of Data in Decision Making

Tracking and analyzing data through tools like Matomo provide invaluable insights into what works and what doesn’t. This data-driven approach ensures informed decision-making, optimizing resource allocation for maximum impact.

Strategic Insights and Future Focus

As we navigate 2024, the data reaffirms our focus on YouTube while prompting a reevaluation of content strategies for Facebook and LinkedIn. Understanding where our efforts yield the best returns allows for strategic refinement and expansion.

Conclusion: Empower Your Business with Data

In conclusion, harnessing the power of data is pivotal to refining your organic lead generation strategies. Whether you’re doubling down on YouTube or exploring automated social media tactics, informed decisions drive sustainable growth.

The post Top Organic Lead Generation Strategies for 2024: Social Media Edition first appeared on Make Money Your Honey | scale your business with marketing & sales systems.

* This article was originally published here

Sunday, December 28, 2025

MrBeast's ex manager explains how to make money without millions of followers - LADbible

* This article was originally published here

Saturday, December 27, 2025

From shrimp Jesus to erotic tractors: how viral AI slop took over the internet - The Guardian

* This article was originally published here

Friday, December 26, 2025

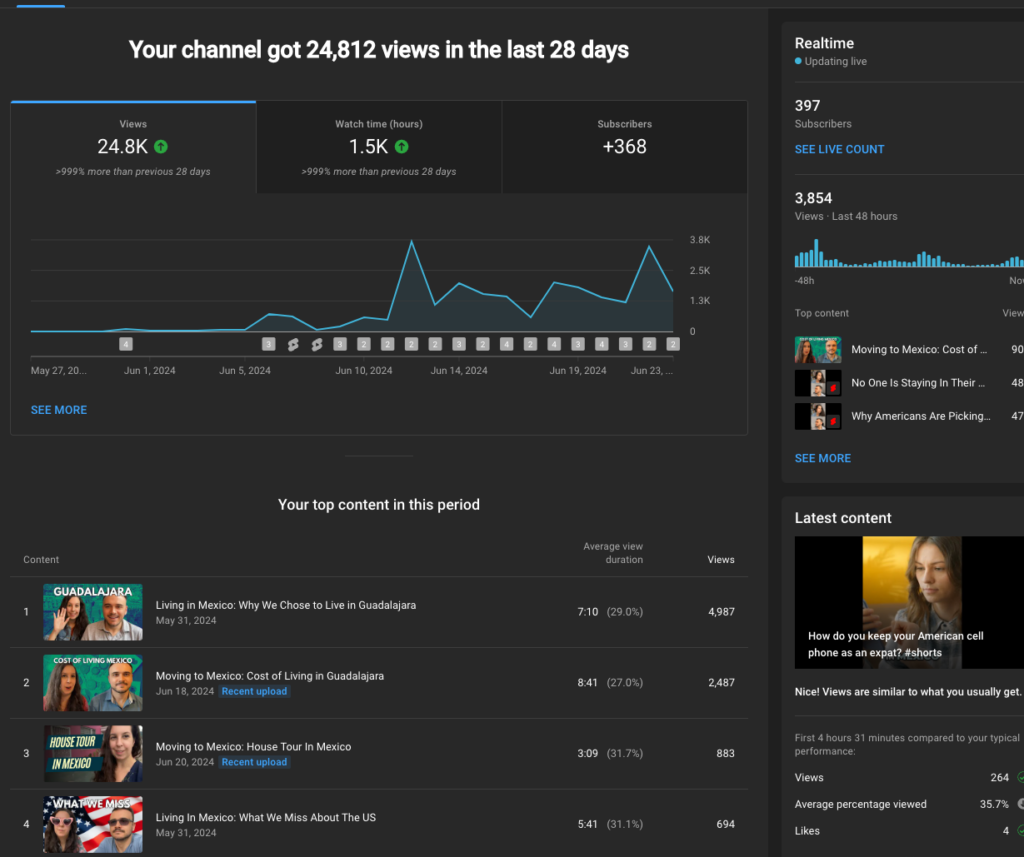

Best YouTube Lead Generation Strategies 2024

Have you ever wondered if YouTube could be a good lead generation strategy for you? Well, in this video, I’m going to share how we’ve achieved tens of thousands of views on a brand new YouTube channel and how it’s consistently adding people to our email list every single day.

Resources Mentioned In This Video:

- Download our free Content Marketing Calendar Template for Notion here.

- Join our Effortless Revenue Mastermind where we do a deep dive on how to use YouTube as a lead generation strategy. Learn more and apply here.

Leveraging YouTube for Lead Generation

YouTube content and strategies have been pivotal in our recent success. Our new channel, “Entrepreneur Expat,” focuses on expat living, particularly in Mexico. Initially, we tested the waters with behind-the-scenes content, which generated interest but remained dormant until recently. In the past month alone, we’ve seen exponential growth with tens of thousands of views, hundreds of new subscribers, and daily leads to our email list—all on autopilot.

Finding Your Niche and Content Strategy

The key to our success on YouTube was finding a niche that resonates deeply with our audience—expat life. This focused approach allowed us to stand out and attract a specific group of viewers interested in moving abroad, particularly to Mexico. By addressing their specific needs and questions, we’ve created a community-driven channel that thrives on engagement and interaction.

Strategic Approach to Content Creation

Strategic planning played a crucial role in our YouTube strategy. Before diving into full-scale production, we conducted extensive SEO and keyword research tailored to the expat community’s interests. This groundwork ensured that our content would not only resonate but also rank well in search results, driving organic traffic to our channel.

Timing and Newsjacking Opportunities

Capitalizing on timely topics and current events further boosted our channel’s visibility. For instance, during periods of significant news coverage related to expat issues or Mexico, we increased our content output. This tactic, known as newsjacking, allowed us to align our videos with trending searches and discussions, significantly amplifying our reach and engagement.

Community Engagement and Value-driven Content

Our channel’s success is also attributed to our commitment to providing valuable, community-oriented content. By directly addressing viewer questions and concerns about moving abroad, we’ve fostered a highly engaged audience. This engagement not only drives views and subscriptions but also facilitates the growth of our email subscriber list through targeted lead magnets like our “Move to Mexico Guide.”

Monetizing Your YouTube Efforts

Lastly, we integrated monetization strategies early on by developing backend funnels and offers tailored to our audience’s needs. This approach ensures that our YouTube efforts not only build our brand but also contribute directly to our business’s revenue streams.

Conclusion

In conclusion, our journey with YouTube as a lead generation tool highlights the power of niche focus, strategic content creation, and community engagement. By understanding our audience, leveraging SEO, and capitalizing on timely topics, we’ve turned our YouTube channel into a thriving platform for lead generation and audience growth. If you’re looking to harness the potential of YouTube for your business, follow these strategies to achieve similar results. Don’t forget to like, subscribe, and share this video with fellow entrepreneurs looking to maximize their YouTube presence. Drop your channel link in the comments below—we’d love to support each other’s growth!

The post Best YouTube Lead Generation Strategies 2024 first appeared on Make Money Your Honey | scale your business with marketing & sales systems.

* This article was originally published here

Thursday, December 25, 2025

Xmas 2025

Hi folks and welcome to the Meaningful Money Podcast, Session number 602. It’s Christmas Eve, so a very Merry Christmas to everyone.

The post Xmas 2025 appeared first on Meaningful Money – Making sense of Money with Pete Matthew | Financial FAQ.

* This article was originally published here

Wednesday, December 24, 2025

The BEST Lead Generation Strategies for Beginners

If I were starting over or starting a brand new business in 2024, these are the organic lead generation strategies that I would focus on from the very beginning. Had I done this from the beginning, I would have saved myself a lot of heartache and headaches along the way. So with that being said, let’s get into it. If I were starting over, what would I be doing in 2024? Let’s break it down.

Resources Mentioned In This Video:

- Download our Social Media Content Planner for Notion here.

- Join our Effortless Revenue Mastermind where we help you implement all of these lead generation strategies. Learn more and apply here.

1. YouTube and Search Engine Optimization (SEO)

I would go all in on YouTube and search engine optimization. Understanding the power of YouTube for generating leads has been a game-changer. YouTube not only drives traffic but also serves as a powerful lead generation tool when optimized correctly. Learning the ins and outs of SEO for both YouTube videos and website content is crucial. This strategic approach compounds over time, making it a cornerstone of my lead generation strategy. It’s because of YouTube that we get new leads every single day.

2. Referral Partnerships

Once YouTube is established and generating consistent leads, I would focus on building referral partnerships. Referral partners can significantly boost your business by sending qualified leads your way. Collaborating on email campaigns and joint webinars are effective ways to leverage these partnerships. Building strong relationships with reliable referral partners ensures a steady stream of leads over time.

3. PR and Podcasting

Lastly, I would focus on PR and podcasting to amplify my reach. Having established a strong presence on YouTube and through referral networks provides the social proof needed to approach media outlets effectively. PR efforts can land you features in publications and guest spots on podcasts, exposing your brand to new audiences and driving additional traffic and leads.

By following this strategic approach—starting with YouTube and SEO, moving on to referral partnerships, and then leveraging PR and podcasting—I would lay a solid foundation for sustainable lead generation and business growth in 2024.

I hope you found these strategies insightful and actionable for your own business endeavors.

The post The BEST Lead Generation Strategies for Beginners first appeared on Make Money Your Honey | scale your business with marketing & sales systems.

* This article was originally published here

Tuesday, December 23, 2025

How to Generate Leads With ONE Social Media Post

If you’ve been posting on social media for your business but aren’t generating leads or sales, this post is for you. Today, we’ll break down how to generate leads with one social media post that got us over 60 leads —completely free—and led to sales for a workshop. These lead generation strategies are designed to help you simplify your efforts and maximize your results.

The Biggest Social Media Challenges

A common complaint among businesses is, “I’m posting all the time, but I’m not getting leads or sales. How do I generate leads with social media?” If this sounds familiar, you might be making one of two key mistakes:

- You’re not posting the right kind of content to generate leads or sales.

- You’re not doing it consistently or strategically.

Lead generation strategies don’t require you to post 30 times a day. Instead, focus on sustainability and learning the right techniques to turn your social media into a lead-generating machine.

Breaking Down the High-Converting Post

Here’s the social media post that generated 60 leads and sales for a $497 workshop. Let’s examine why it worked and how you can replicate its success.

The Hook: Grabbing Attention

The post started by referencing a trending topic: Alex Hormozi’s latest video on the highest-converting social media platforms. This strategy leveraged a recognizable name and timely content to hook the audience. Key takeaways:

- Tap into trending topics: Referencing industry leaders adds credibility and relevance.

- Address pain points: The post immediately spoke to business owners overwhelmed by managing multiple social media accounts.

Highlighting Results

The post shared impressive results: generating six figures in sales in 90 days using YouTube without spending a dime on paid traffic. This highlighted the effectiveness of focused lead generation strategies and appealed to an audience seeking simplicity and sustainability.

Value-Driven Insights

The post continued by sharing valuable data:

- Higher quality buyers: 80% of U.S. households earning $100,000+ are active on YouTube.

- Higher conversion rates: YouTube converts at three to four times the rate of other platforms.

- Long-term benefits: YouTube’s SEO ensures that content continues to grow over time.

This approach worked because it combined expert insights (Alex Hormozi’s findings) with personal experience, reinforcing credibility and building trust.

Transparent and Honest Content

One standout element was the transparency in comparing results. The post openly acknowledged differences between Hormozi’s findings and personal data, which built authenticity. Honesty in social media posts fosters trust, leading to better engagement and conversions.

Call-to-Action (CTA): Driving Engagement

The post ended with a clear CTA:

- Offer details: The workshop covered actionable tips, like setting up a YouTube channel for algorithm success and optimizing content for daily leads.

- Limited spots: Exclusivity (20 participants max) created urgency.

- Multiple entry points: Options to comment “interested” or send a direct message (DM) made it easy for the audience to engage.

This dual CTA approach catered to different preferences and ensured maximum engagement.

Why Belief Matters in Lead Generation

Beyond strategies and skills, mindset plays a critical role. Many business owners struggle to believe that generating leads and sales can be simple. However, by focusing on effective lead generation strategies and embracing the ease of digital tools, you can achieve incredible results—like 60 leads from a single post.

How to Generate Leads Every Day

- Track What Works: Use a spreadsheet to monitor social media posts, engagement, and conversions. Analyze trends and optimize accordingly. We give this exact spreadsheet in the video to our Effortless Revenue Mastermind clients.

- Leverage Trends: Align your content with trending topics or expert insights to boost credibility and visibility.

- Simplify Your Efforts: Focus on high-converting platforms like YouTube and master one channel instead of spreading yourself too thin.

- Create a Clear CTA: Make it easy for your audience to take action with clear instructions and a sense of urgency.

- Be Honest: Transparency builds trust and fosters long-term relationships with your audience.

Final Thoughts

Lead generation strategies don’t have to be complicated. By combining the right content, consistent effort, and a belief in simplicity, you can achieve remarkable results. If you’re ready to learn more, consider joining our YouTube Mastery Workshop or exploring our Effortless Revenue Mastermind program.

Don’t miss the opportunity to turn your social media into a lead-generating machine. Start implementing these strategies today and watch your business grow!

The post How to Generate Leads With ONE Social Media Post first appeared on Make Money Your Honey | scale your business with marketing & sales systems.

* This article was originally published here

Monday, December 22, 2025

AI is bigger than the internet but people are bigger still - Utility Week

* This article was originally published here

Sunday, December 21, 2025

How AIM taught the internet to chat - The Verge

* This article was originally published here

Saturday, December 20, 2025

Ask HN: The internet is getting worse every day. How do we fix this? - Hacker News

* This article was originally published here

Friday, December 19, 2025

Listener Questions – Episode 36

Questions Asked

- Question 1

Big thanks to Pete and Roger for all the excellent advice.

This question is for some of the 2.8 million UK landlords. Even those with just one property in their own name—not through a limited company—are increasingly affected by fiscal drag.Looking ahead, I plan to sell down much of my property portfolio in later life (because who wants to be a landlord at 70?). Plus, mortgage finance becomes trickier in your 70s. That said, even if I retain one or two of the best properties, the rental income alone may push me into the higher-rate tax bracket.

I’m 49 and don’t currently have a SIPP, but I can invest up to the £60k annual allowance via my limited company. Would it make sense to start building a modest pension over the next 10 years as a risk mitigation strategy?

If so, how should I think about the opportunity cost? I’d save 25% corporation tax going in, but pay higher-rate income tax on the way out (less the 25% tax-free lump sum)—so is the net tax cost around 5%? Or am I overlooking other factors, like the benefit of CGT and income tax exemptions on growth within the pension?

Appreciate your thoughts—and keep up the great work.

Regards, Cameron.

- Question 2

Hi Pete, Roger and Nick,I’ve recently discovered your YouTube channel and podcast, and it’s been a real eye-opener – thanks so much for all the great content!

I’m 45 and currently have £74,000 in a Fidelity SIPP, but it’s all sitting in cash. I know that’s far from ideal, especially with 15–20 years until I plan to retire. I also realise it’s a relatively modest pot for my age, and it’s not earning anything while it just sits there.

How would you typically advise someone in my situation to begin investing some or all of that cash? I’m keen to make up for lost time but want to do so wisely.

Thanks again, and keep up the brilliant work!

Joanne - Question 3

Hi Pete & Roger,Firstly thanks so much for all your hard work – I devour your podcasts, videos & books – so much hard work on your behalf & I hope you realise how appreciated they are.

I am just at the stage of life where in the next few years I need to start thinking about drawing money out of mine & my husband's pensions and I am considering the most tax efficient way of doing this. I have been reading all about UFPLS and FAD. As background, it is unlikely that either my husband or I will ever have much Personal Allowance unused in the years up to receiving our State Pensions due to rental income we receive; it is also unlikely that either of us will ever become higher rate taxpayers. I also understand that to get the most out of ones PCLS it is best to only crystallise the funds actually needed from an uncrystallised pension so the rest of the pot can hopefully grow and therefore the 25% tax free sum also grows.

So, my question is, what am I missing, in what situations would it be more beneficial to take an UFPLS payment v making a partial crystallisation into a FAD pot (I am with ii who offer this).I feel like an UFPLS payment would give me 25% tax free and 75% taxed right away, whilst a FAD would give me the same 25% tax free and 75% could be taken straight away or drawn down over time as desired and could also be left invested to hopefully grow?

Thanks so much, Tracy

- Question 4

Hi Pete and Roger, thanks for hosting such a great podcast!I’ve recently been searching for a new job and was lucky enough to receive an offer with some interesting compensation features that I thought I would ask your opinions on. I actually turned down this role in favour of something else, but wanted to ask nonetheless as the offer came with an interesting feature that I have not come across before.

Firstly, and probably most straightforward to answer – The salary on offer was £50,500 per year, which seems a weird figure – suspiciously only slightly above the threshold to tip me into the higher tax bracket, which got me thinking – are there any benefits (to the employer or employee) of being only just into the next tax bracket up? Why not £50k, or £51k?

Secondly, in addition to a very generous DC pension scheme (they would pay in 12% if I pay in 5%) they offer a “Savings Scheme” whereby 5% of my salary would be deducted (and paid into this scheme) each month and at the end of 12 months the company would then top up these savings with another 5% of my annual salary – (actually 6% to “account for the extra tax”). My real question is this – what are these “savings schemes” in a nutshell, and are there any benefits of them over trying to negotiate for increased employer pension contributions instead?

Interested to hear your thoughts on these.

Thanks so much!

Jamie - Question 5

Hello Pete and RogerI've recently found your podcast and wanted to say thanks for all the insight you are providing. Not only do you make a fairly dull subject tolerable, you even manage to make it reasonably enjoyable

My wife and I have a couple of rental properties which should be paid off along with the house in a year or so.

I'm 47 and on an average salary. I have a medical condition which means I'll probably be unable to carry on working till 67 (but life expectancy unaffected). The problem I have is I don't know when I'll need to access my personal pension so planning is a bit tricky.

My DC pension pot is just over £200k which ordinarily would be quite healthy but if I have to access it at 57 suddenly it isn't so great.

I'm currently invested 100% in shares and have been a bit braver than I'd normally be inclined, as I feel I need to make hay while the sun shines, but now getting to the stage where I might want to reduce the risk on the money I've worked hard to save.

The problem I have is knowing how to go about planning for an uncertain future.

I'm also aware I have a blind spot when it comes to bonds. I know they are meant to fare better than shares in falling markets but not sure if the reality matches the reputation. Fundamentally I just don't understand the mechanics of how they work and what factors affect how they move.

Would be very grateful to hear your thoughts!

Thank You and keep up the good work.

Danny - Question 6

Hi Pete and Roger,I'm 31 and have been listening to this podcast for at least 10 years so have been very lucky to have baked all of your wisdom and advice into my own financial habits over the formative years of attending university and entering the world of work, which has undoubtedly set me on the right path for the rest of my life – I hope! I can't thank you enough for your generosity and dedication to this mission.

My question is maybe an unusual one…

I am fortunate to be in a well-paid job in what I think is a relatively secure career and have all of the basics covered – from a good EM fund, no debt and money put into wealth-building mechanisms (pension and Stocks and Shares ISA). I have more than enough to be comfortable.

Unfortunately, a couple of years ago my brother got diagnosed with a rare cancer at the age of 26 and has been battling the condition ever since. He's spent a lot of time in the care of the national treasure that is The Christie in Manchester, and I'm so grateful for the work they have done to support him and would like to financially donate to them so that I can do what I can to help them and others in return.

I get (what I consider to be) a significant pre-tax annual bonus to the tune of £10-15k and am considering donating this in one-off charity contributions through my employer's benefit scheme each year when I receive it. Alternatively, I could pension-dump these bonuses and build a strong compounding engine for retirement one day and at that point could then donate a substantially higher figure (potentially even just from interest on the core portfolio alone..?).

Whilst I won't ask you to answer what is probably an impossible question on behalf of The Christie in terms of which is more important – money now or money later – do you have any thoughts on the pros and cons of either approach? Is there a right answer here in your opinion?

Thanks again for all you do

Tom

Send Us Your Listener Question

We’re going to spin out the listener questions into a separate Q&A show which we’ll drop into the feed every 2-3 weeks or so. These will be in addition to the main feed, most likely, but they’re easier for us to produce because they require less writing! Send your questions to hello@meaningfulmoney.tv Subject line: Podcast Question

The post Listener Questions – Episode 36 appeared first on Meaningful Money – Making sense of Money with Pete Matthew | Financial FAQ.

* This article was originally published here

Thursday, December 18, 2025

Top 5 Technology Trends to Watch in 2026

As technology continues to evolve at lightning speed, 2026 is shaping up to be a pivotal year for the integration of artificial intelligence, cloud computing, and intelligent operations. Organizations will need to combine innovation, resilience, and digital sovereignty to stay competitive in an increasingly interconnected and fast-changing world.

1. 2026: The Year of Truth for Artificial Intelligence

After years of experimentation, artificial intelligence (AI) is entering a true maturity phase. Businesses are moving from pilot projects to large-scale deployments, shifting from proofs of concept to proofs of impact. AI is no longer a side tool — it’s becoming the backbone of enterprise architecture and strategic decision-making.

This new era of AI emphasizes the “human–AI synergy” — collaboration, trust, and explainability. Leaders are investing in high-quality data, robust governance, and workforce training to fully leverage AI’s transformative potential while ensuring transparency and ethics remain central.

Learn more about the impact of AI in business (McKinsey)

2. AI Is Rebuilding Software Development

The software development lifecycle is undergoing a revolution. Thanks to generative AI, developers no longer need to write every line of code manually — they simply describe their intent, and the AI turns it into executable logic. This automation speeds up delivery, reduces costs, and improves overall quality.

However, success requires strong governance and human oversight. Companies must focus on quality control, cybersecurity, and responsible automation. In 2026, organizations will reskill their development teams to collaborate with AI agents and design systems that continuously learn and adapt.

Read: How AI is transforming software development (Forbes)

3. Cloud 3.0: A New Hybrid and Sovereign Era

Cloud computing is entering its next evolutionary stage — the era of Cloud 3.0. Beyond multi-cloud and hybrid models, this new generation of infrastructure focuses on sovereignty, performance, and resilience. Organizations are blending public, private, and edge computing environments to achieve flexibility, low latency, and security at scale.

This shift is driven by the growing need to host AI systems efficiently and ensure business continuity amid geopolitical uncertainty. Cloud 3.0 enables modular, distributed architectures that promote data portability, interoperability, and autonomy — key to maintaining both innovation and control.

Explore the future of Cloud 3.0 (Google Cloud)

4. The Rise of Intelligent Operations

Enterprise systems are evolving from static management tools into dynamic, living networks of intelligent operations. Powered by AI agents, these systems can monitor processes, optimize workflows, and even make predictive adjustments before problems occur.

This “co-pilot” model — where humans supervise and AI executes — brings agility, precision, and proactivity to daily operations. In sectors like finance, logistics, HR, and customer service, intelligent operations are transforming how value chains are orchestrated, moving organizations from reactive to proactive management.

Read the Harvard Business Review analysis on intelligent operations

5. The Paradox of Borderless Technological Sovereignty

As global tensions reshape digital ecosystems, technological sovereignty has become both a political and strategic imperative. Governments and enterprises alike are seeking to secure control over critical technologies — data, semiconductors, AI, and cloud infrastructure — without isolating themselves from the global digital economy.

This new paradox creates an environment of resilient interdependence. In 2026, organizations will diversify suppliers, embrace open-source and regional AI models, and invest in sovereign cloud and data ecosystems to strengthen business continuity and reduce dependency risks.

Learn more about digital sovereignty (World Economic Forum)

Conclusion: A More Human, More Strategic Tech Future

The five technology trends defining 2026 reflect a global shift toward smarter, more resilient, and more human-centric innovation. AI, Cloud 3.0, intelligent operations, and digital sovereignty are no longer buzzwords — they’re strategic foundations for the next phase of digital transformation.

As technology moves from experimentation to impact, organizations that balance innovation with ethics, automation with human oversight, and speed with sustainability will define the new standard for success in the digital age.

The post Top 5 Technology Trends to Watch in 2026 appeared first on Internet Business Mastery.

* This article was originally published here

Wednesday, December 17, 2025

France Franchise 2026: Market Notes from the Opportunity Window

France isn’t just “open for franchising” in 2026—it’s a market where franchise France plays compound when everyday needs meet disciplined operations and French-first proof. This is a blog take: what feels real on the street, what is post-hype, and where marketing actually moves outcomes.

The 2026 mood: fewer slogans, more substance

Consumers are selective and price-aware, yet they reward reliability, proximity and transparency. In franchising, that translates into tighter training, consistent delivery, and visible after-sales. The opportunity is there; the filter is tougher. Formats that work in ordinary weeks, not just launch-week fireworks, are the ones that stick in 2026.

Tell-tale sign: a site that’s calmly busy on a random Tuesday 6:30pm with steady staffing—operational truth beats opening-day theatre.

Where momentum feels durable

Personal & home services ride repeat usage and neighbourhood trust. Food & beverage continues where ops travel beyond the founder’s street (fast-casual, bakery/coffee with cost discipline). Wellness & beauty turn reviews and rebooking into a flywheel. Automotive & mobility hold need-based intent (tyres, quick repair, EV services). Education & upskilling leverages content depth and partnerships. Not flashy—durable when store math holds.

Brand promise vs. store math

Ambitious decks stall when staffing, rent and acquisition costs don’t line up. Candidates ask sharper questions: ramp, break-even sensitivity, shift coverage and pipeline seasonality. Brands that publish prudent scenarios and align marketing cadence with ops speed get decisions faster than those promising “viral growth”.

Signals you can actually observe

| Signal | What to look for | Why it matters |

|---|---|---|

| Weekday traffic | Steady 6–8 pm flow without promo spikes | Health in ordinary weeks beats launch noise |

| Reviews pattern | Recent, specific, reply-in-French within 24–48h | Ops responsiveness is a growth channel |

| Staffing stability | Consistent faces across weeks | Training/turnover under control |

| Ticket logic | Visible price architecture that matches neighbourhood | Pricing alignment sustains margin |

City vs. region dynamics (field view)

| Area type | Rent/Capex | Talent supply | Customer mix | Note |

|---|---|---|---|---|

| Prime metro | High | Broad but competitive | Tourists + locals | Visibility is easy; cost discipline is hard |

| Secondary city | Moderate | Stable | Local repeaters | Often the best first-unit balance |

| Regional town | Low to moderate | Narrower pool | Community-centric | Win with proximity and partnerships |

Marketing that actually converts (in France)

- Intent capture on Search & Maps with genuine French localization and fast review replies.

- In-French case stories that include “what went wrong and how we fixed it”. Authentic beats glossy.

- Neighbourhood gravity: small partnerships (schools, clubs, workplaces) outperform broad discounts.

- Cost hygiene: media scale only after month-3 P&L is stable, not the other way around.

Operator habits we keep seeing in winners

- Proof over pitch: weekly micro-wins instead of generic slogans.

- Roster realism: schedule for the traffic you have; staff for the traffic you want.

- Price clarity: visible ladders, no surprise fees.

- Review ritual: request, reply, resolve—in French, within 24–48h.

Keeping a finger on the pulse

Static lists age quickly; living resources help you pressure-test formats against capital, timeline and territory. For sector overviews and evolving shortlists, browse this curation: France franchise selection (FR). For a neutral ecosystem view (events, data, definitions), consult the French Franchise Federation: franchise-fff.com.

Closing note

2026 isn’t handing out easy wins. It rewards ordinary excellence: useful formats, steady operations, and proof your neighbours can actually see. When those line up, franchise 2026 becomes less about noise and more about trust compounding week after week.

The post France Franchise 2026: Market Notes from the Opportunity Window appeared first on Internet Business Mastery.

* This article was originally published here

Tuesday, December 16, 2025

10 Easy Ways to Make Money With ChatGPT (No Tech Skills Needed) - Investopedia

* This article was originally published here